G’day, fellow Aussie content creators. We’ve all been there, wondering how to invoice as a freelancer in Australia – especially when you’re starting out.

How do I make an invoice? I don’t even have an ABN! Do I need an ABN? What do I do?! Don’t worry. Let’s go step by step through a basic How to: Invoice, and we can go from there with next steps.

This is relevant for all freelancers and creators, whether you’re making video content, snapping photos for UGC, writing blog posts or doing the odd review – it’s essential to keep your creative journey organised.

Note that this isn’t financial advice, and we highly recommend reading the relevant ATO links and government documents.

Invoice vs Tax Invoice For Freelancers

If you’re registered for GST, your invoices should be called ‘tax invoice’. Not registered for GST? Your invoices should not include the words ‘tax invoice’ – you must issue standard invoices.

If a brand requests a tax invoice and you’re not registered for GST, provide a regular invoice showing there is no GST included in the price – and make sure to let them know that is the case.

You can do this by including the statement ‘No GST has been charged’ or by showing the GST amount as zero. Learn more here, How to invoice from the ATO.

Much of the information included won’t change invoice to invoice. The first one created always has the most information gathering, then everyone after can be a slightly edited version of the first.

How to Invoice as a Freelancer in Australia: Get Your Information Together

Before we dive in, gather the info you’ll need:

- Your details: Put down your full legal name (no nick names), contact information, billing address (this will be the same as your residential address unless you have an office address), and any social media or online profiles/aliases you go by online. This all sits with itself in your invoice.

- Client’s information (also known as the “billed to”): Note your client’s name or handle/username (if they have one) and their contact details. Make sure to “attention it” to the person you’re liaising with, or whoever they request the “ATT: Accountant Sam”.

- Invoice number: Make a unique number for your invoice that can change when you’re creating other invoices (like INV001).

- Reference number or job number: A brand may request you to include a reference or job number for their records and easier internal tracking. Include it near the invoice number, labelling it’s description clearly.

- Invoice date: Write down the date you are sending the brand the invoice.

- Payment terms: Say when you’d like to get paid. Add a late fee disclaimer such as “Please be aware that we will charge a 10% fee for total invoice cost per week on late invoice payments.”

- Describe your services briefly or scope: Explain what you did – whether it’s shooting videos, taking photos, writing, or designing.

- Rates: If you charge by the hour, tell them how many hours you worked and your hourly rate. If it’s a fixed price, state that.

- Payment details: Be clear on how they can pay, whether it’s through PayPal, bank transfer, or something else. You can provide multiple options.

How to Invoice Brands as a Content Creator

Invoicing for UGC, Reels, and Brand Deliverables

Whether you’re invoicing for UGC, reels, blog posts, or social content, the basics stay the same. Clearly describe what you delivered and ensure it aligns with what was agreed upon.

Invoicing for One-Off Campaigns vs Ongoing Work

Much of this information won’t change between invoices. Once you’ve created your first invoice, future invoices can usually be slightly edited versions of the original.

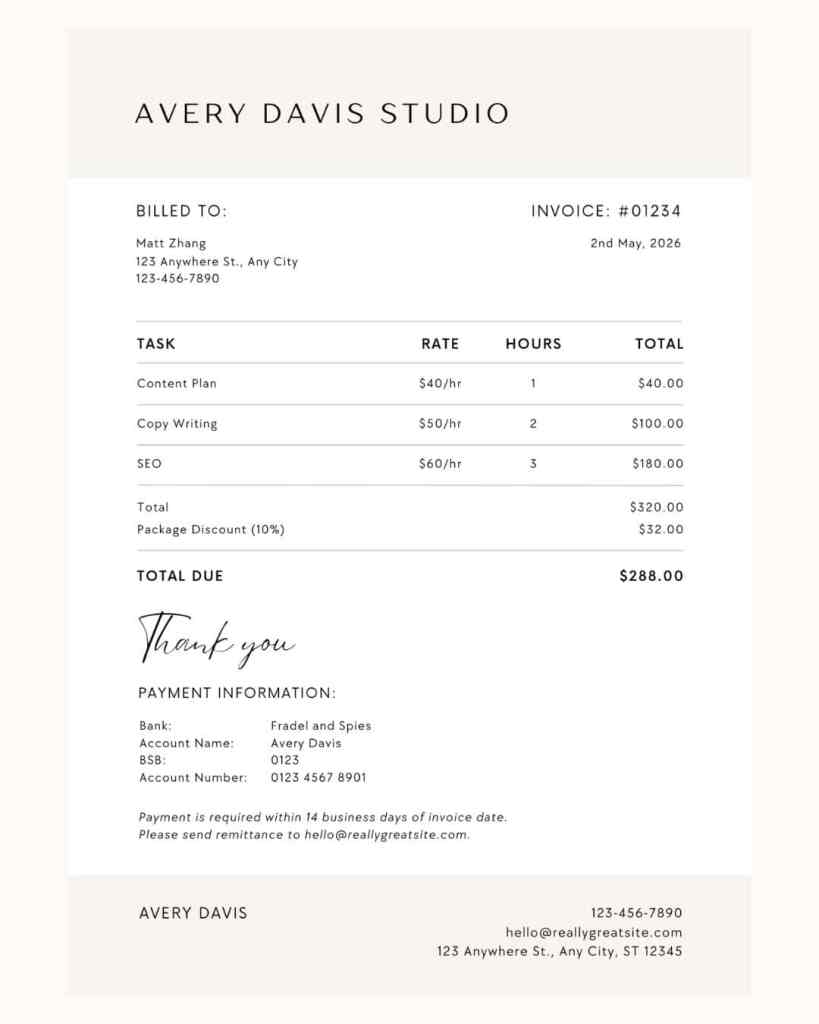

Grab an Invoice Template

Pro Tip: Leave the cuteness for the content. Straightforward, plain invoices are the easiest for brands to process.

Find an invoice template online that suits your style and needs. You can find loads of free options out there, our favourites are on Canva. Just search “Invoice” and hundreds of free templates pop up.

This is the one we’ve used above: “Gray Black White Minimalist Elegant Freelancer Invoice”

How to Pay You

Make sure it’s crystal clear how they can pay you. Share your PayPal email or bank details, so there’s no confusion. You can provide multiple methods of payment.

Invoice Payment Terms Explained for Freelancers

What NET 7, NET 14, and NET 30 Mean

Payment terms simply outline when you expect to be paid. Common options are 7, 14, or 30 days, and these should always be clearly stated on your invoice.

These terms should be previously agreed on if there’s been any contract. It’s important that they’re aligned with what has been agreed upon.

Late Fees and When to Include Them

If you choose to include a late fee, make sure it’s written clearly on your invoice and in your contract so there are no surprises.

Note: you won’t be able to fairly apply a late fee unless there’s a signed contract previously.

Check, Double-Check

Before sending your invoice, give it a once-over:

- Make sure everything’s accurate.

- Check the maths, twice! Does the total and hours all add up?

- Review the payment instructions one more time.

- Note the due date in your calendar so you can chase up late payments.

- Did you include GST? (If you charge GST)

Save and Send

Make sure it gets to the right people, without confusion.

Did they ask you to CC accounts? Are they requesting you fill out a supplier form? Send all the relevant financial details over in the one email.

Attach your invoice as a clearly labeled PDF, including any references they’ve asked you to use for easy identification.

Get Paid!

Once your invoice is out there, keep an eye on the due date and follow up with reminders if necessary. Many online tools can automate this for you. Consider using an online tool to do the stress going forward.

Zoho Invoice is a free invoicing software we highly recommend and use internally.

Common Invoicing Mistakes Freelancers Make in Australia

Mistakes are normal when figuring things out for the first time, but extra important to avoid when it comes to finances.

When in doubt, make sure to chat to the right people, or even clarify with who you’re billing.

Here’s some common mistakes made we see:

Calling an Invoice a Tax Invoice Without GST Registration

If you’re not registered for GST, your invoice should not be labelled a tax invoice, nor should it include a GST amount.

Forgetting Payment Terms or Due Dates

Always include clear payment terms so brands know exactly when payment is due. Saves you a lot of trouble following up, or having your invoice lost.

Not Saving Invoice Records Properly

Keep copies of all invoices sent and paid for your records.

Easy Invoicing Tools & Guides

- Invoicing tool for Aussie freelancers

- How to: Freelance invoicing guide

- How to: Invoice via business.gov.au

- Payments and invoicing hub

- Zoho Invoice

Do You Need an ABN When You’re Starting Out as A Creator or Freelancer?

You can apply for an ABN for free through the ATO here.

It’s a free and easy process – but you might not be eligible for one, and ABNs that go unused are cancelled by the ATO. You are able to get your ABN reinstated at any time, even if it’s been cancelled – but it’s best to apply for one when you know you’re eligible.

Here’s some points to understand before applying for an ABN:

- Key differences: Hobby VS Business

- You can fill out a Statement by a supplier form if a brand requests your ABN but you aren’t eligible for one.

- Call the ATO on 13 28 61 to explain your specific situation if you’re unsure.

Frequently Asked Questions About Invoicing as a Freelancer in Australia

Do I need an ABN to invoice as a freelancer in Australia, even if I don’t make much money?

No, you don’t always need an ABN to invoice as a freelancer in Australia. If you’re operating as a hobby rather than a business, you may not be eligible for one.

If a brand requests your ABN and you don’t have one, you can fill out a Statement by a Supplier form instead.

Can I invoice without being registered for GST?

Yes. If you’re not registered for GST, you can still invoice clients. Your invoice just must not be labelled a ‘tax invoice’, and it should clearly state that no GST has been charged, or show the GST amount as zero.

What’s the difference between an invoice and a tax invoice?

A tax invoice is only used if you’re registered for GST. A standard invoice is used if you’re not registered. The main difference is whether GST is included and whether the invoice is labelled as a tax invoice.

What needs to be included on a freelancer invoice?

A freelancer invoice in Australia should include your details, the client’s details, an invoice number, invoice date, a description of services, rates, payment terms, and payment details. If you’re GST-registered, it must also include your ABN and GST amount.

Can I use a Canva template for invoicing?

Yes. Canva offers a range of free invoice templates that are suitable for freelancers and content creators. Straightforward, clean templates are usually the easiest for brands and finance teams to process.

How long should payment terms be on an invoice?

Common payment terms are 7, 14, or 30 days. You should clearly state your preferred payment timeframe on your invoice and can include a late payment disclaimer if needed.

What should I do if a brand pays late?

If a payment is overdue, follow up politely after the due date. Keeping track of due dates and sending reminders is part of freelancing. Many invoicing tools can automate reminders to make this easier.

Can I invoice international brands as an Australian freelancer?

Yes. You can invoice international brands, even if you’re based in Australia.

Payment details should be clear, and GST is generally not charged on overseas clients, depending on the service provided. Make sure to clarify charging currency, and include a SWIFT/BIC code. Contact your specific bank to get your code.